The New York City rental real estate market has a reputation for being fast-paced, intimidating, and expensive. If you’re new to New York, the “40x rent rule” may come as a surprise as you try to navigate through the rental market here.

Landlords and property managers in the city take many steps to ensure they lease their properties to tenants who can pay rent on time, and one of these steps is gross income requirement, also known as the 40x rent rule, where property owners look for tenants who have a yearly income that is 40x greater than the monthly rent price. According to the most recent data from the Census Bureau, the median household income in New York City is $70,663. This means that to qualify for a two-bedroom apartment, a family of two can only afford to spend $1,767 on rent.

This report highlights the required income for an apartment at the median price in various neighborhoods, broken down by room size, to help you understand how much income you must make to qualify for an apartment.

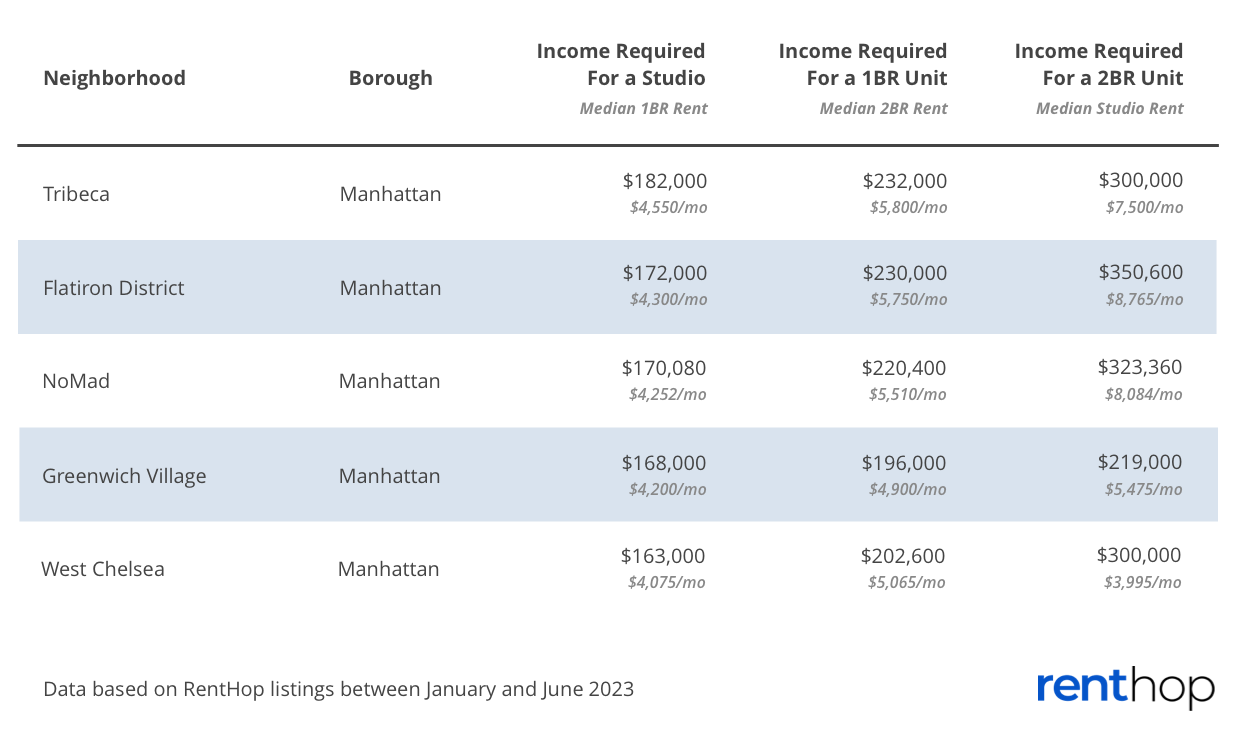

Neighborhoods with the highest income requirement for a studio apartment

For those who prefer to live in a studio, we have some bad news. According to the most recent RentHop Singles Index, New York is the least affordable city in America for singles. This also means that an individual would need to make significantly higher income to qualify for a studio. TriBeCa, one of the most expensive neighborhoods in New York City, has the highest income for a studio apartment. Renters wishing to rent a studio would need to make $182,000 to satisfy the 40x income rule. Meanwhile, Greenwich Village ranks the fourth, with a median rent of $4,200 a month for a studio, which translates to a required $168,000 a year in gross income.

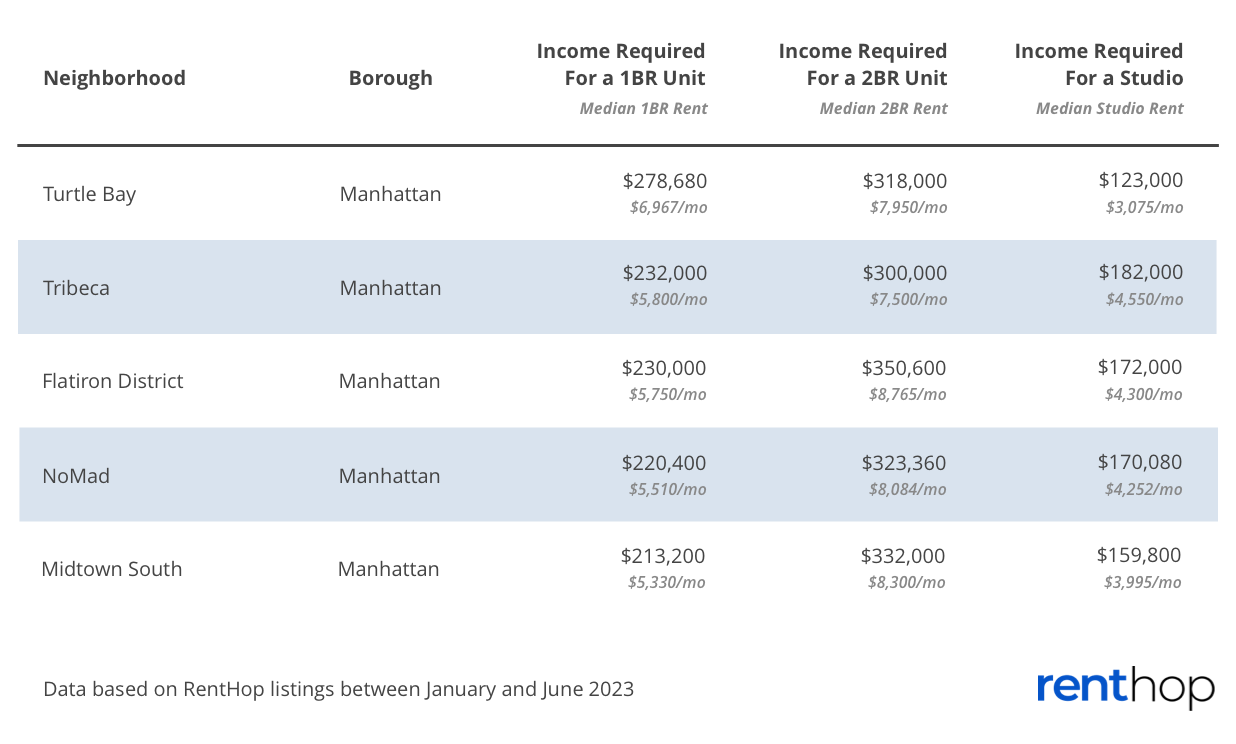

Neighborhoods with the highest income requirement for a one-bedroom apartment

Among the 170 neighborhoods included in this report, Turtle Bay has the highest income requirement for a one-bedroom apartment. To qualify for a one-bedroom unit, renters would need to make around $278,680 a year in gross income, based on a median rent of $6,967 per month. Midtown South ranks the fifth highest with an income requirement of $213,200.

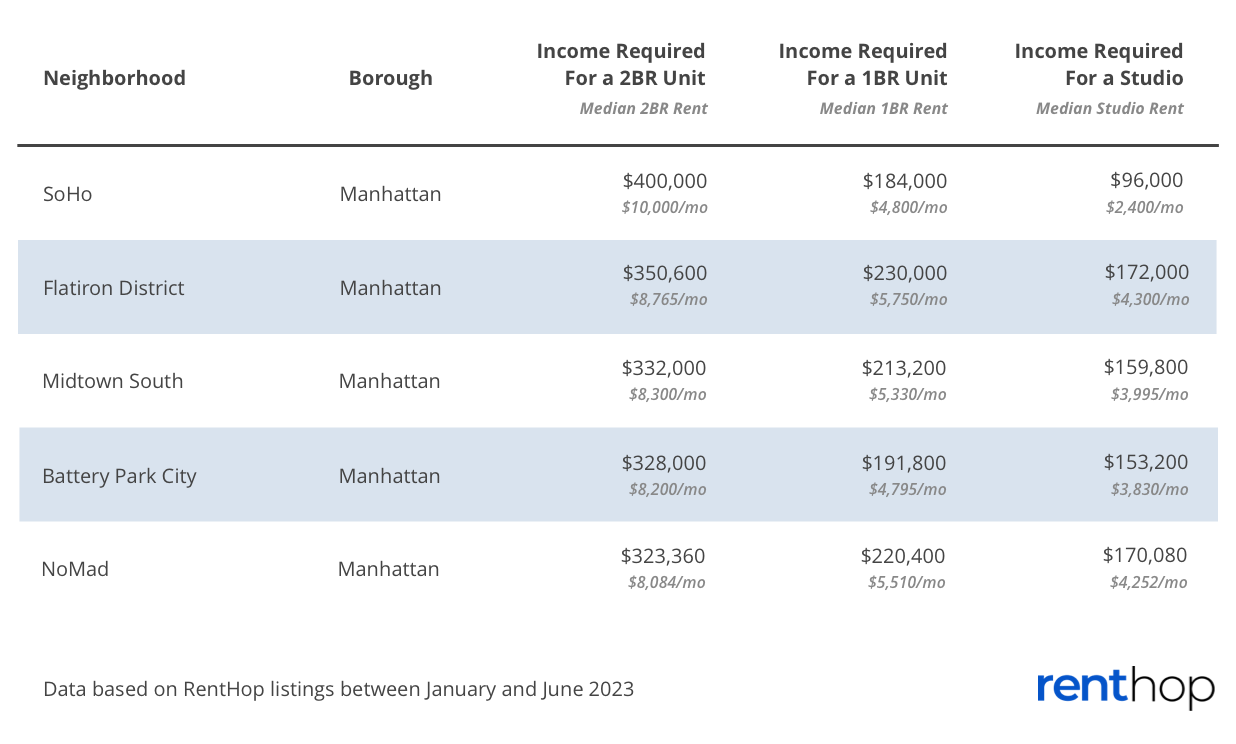

Neighborhoods with the highest income requirement for a two-bedroom apartment

Not surprisingly, the five neighborhoods with the highest income requirement for a two-bedroom apartment are all in Manhattan. With a median rent of $10,000 a month, renters looking to sign a lease in one of the commercial loft converted units in SoHo will need to make a whopping $400,000 a year in gross income to meet the qualifications. Meanwhile, renters looking to rent a two-bedroom apartment in Flatiron District may need to face an income requirement of $350,600 a year.

Consider renting in these neighborhoods if your annual income is below $80,000

New York City, specifically neighborhoods in Northwestern Queens and Brooklyn, have become increasingly expensive in the past year. However, for who are open to traveling farther, there are still ways to find affordable options and therefore avoid using a guarantor. Flatlands in Brooklyn is one of the most favorable options for renters making less than $80,000 a year. The income requirement rule for a one-bedroom unit is $74,000, based on a median rent of $1,850. Similarly, Concourse in the Bronx is another great neighborhood, with $78,000 required for a one-bedroom apartment.

Tips for Renting in NYC

Looking for an apartment in New York City? Consider the following tips to make your process as seamless as possible:

1. Understand the market

The real estate market in New York City varies by neighborhood. Take time to research the neighborhood(s) you’re interested in moving to. Scroll to the bottom of a search page to view the current median rent for a neighborhood based on room size. Or, check out the RentHop Average Rents tool to see the current and historical rent for specific neighborhoods. Understanding how much you’re on the hook for can help you mentally prepare for rental prices or have enough time to consider moving to a different neighborhood.

2. Find a roommate

Having a roommate (or more) is a great way to reduce your housing cost. When applying for an apartment, landlords usually require that each renter make 40x their share of the rent. This gives renters more options and even qualify for homes with more amenities. For example, in Gowanus, the 40x rent rule would require a renter to make $159,800 a year for a one-bedroom apartment. This income requirement would be reduced to, on average, $90,860 per person if you rent a two-bedroom with a roommate.

3. Prepare your application materials

The real estate market moves quickly, especially in the summer. Before you inquire about a listing, get your application materials ready. Combine them all in an online folder that is easily accessible. When you tour an apartment you like, you’ll be one step closer to submitting an application as soon as possible. Click here to view a list of application materials that most landlords and management companies require.

4. Gather your finances

In New York City, landlords and management companies cannot ask for more than the first month’s rent, a security deposit that does not exceed one month’s rent, and a $20 application fee to rent an apartment. If you work with a real estate agent, that agent may also charge a broker’s fee that typically ranges between one month’s rent and 15% of the yearly rent. Put your money for an apartment in one account so you can easily submit payment once you receive an approval. Living with roommates? Your new landlord or property manager may ask for one check, so make sure you have a way to easily send funds between parties so one person can submit the entire first month’s rent and security deposit.

5. Acquire a guarantor

If your income does not exceed 40x the rent and your credit score is low or nonexistent, you can use a guarantor to qualify for an apartment. The guarantor must make 80x the income and have a credit score above 680. Some landlords may require your guarantor to live in-state or in the region. If you do not know someone who can be your guarantor, you can hire an online platform to provide guarantor services. Note that online guarantors charge a fee for their services.

6. Establish your timeline

Since apartments rent quickly in the city, most active listings will ask for tenants who can move in within the month. Therefore, you can start your search process a month out from your move date. For example, if you’re looking for an August 1st start date, you will find the most available apartments from July 1st through the 31st.

7. Verify your agent

If you inquire about a listing that seems too good to be true, ask for the agent’s license number. You can then input that number into eAccess (the New York licensing management system), and if the number returns the agent’s name, they currently hold a real estate license. Additionally, you can run an online search for the agent and their brokerage to ensure they have successfully worked with renters. Pro Tip: RentHop requires advertisers to complete a one-time verification process to prove their identity. You’ll see a green checkmark next to an agent’s photo when they’ve successfully completed this process.

Ready for more tips on the NYC rental process? Review our Rental Guide!