Once you find an apartment and decide that you want to live there, it is time to assemble and submit an application. Ideally, you should read through this section before viewing apartments and then organize your paperwork, so you are ready to submit right when you find a desirable home.

What is an apartment application?

To rent an apartment, most spaces in New York City require that prospective renters submit an application that communicates personal information like their employment history, credit score, and ability to pay rent on time. Since many landlords and management companies never physically meet their tenants, the application process is the owner’s chance to screen their tenants to ensure they accept reputable residents in the building.

Fundamentally, a landlord wants to accept respectable tenants who will pay their rent on time and not destroy their property. Therefore, the landlord utilizes the information in the application to judge if the tenant is a proper fit for their building.

Once prospective you submit an application, you will typically know if you are approved or denied within two to three business days. In the busier rental season, you may know within a day or a few hours.

Required documents for an application

To submit an application, most landlords and management companies require that you fill out an application form and then attach several documents to the form. This creates an application packet, which the agent organizes and then submits to the owner for review.

The application form will ask for information regarding your income, contact information, social security information, employment history, etc. You will attach supporting documents to help the landlord verify the information from the application form.

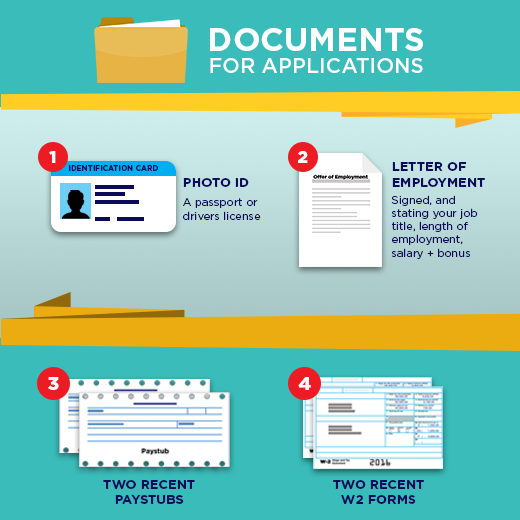

The supporting documents include:

- Photo ID (passport or driver’s license)

- Letter of employment (usually on company letterhead that states the job title, length of employment, and salary)

- Copies of the last two pay-stubs

- Copies of the last two tax returns

- Asset documents (such as brokerage accounts or property deeds)

- Contact information for past landlords/employers/guarantors*

- Letters of reference from past landlords*

- Copy of a recent utility bill*

* These last three are usually not required but are recommended as they help an applicant appear more reliable

If you apply for the apartment with a guarantor, your guarantor will also need to submit the above documents.

Application Fee

In the past, prospective renters were able to offer large sums of money to a landlord as that was then used to cover rent for the entirety of that lease duration. Landlords could label this money as an application fee, security deposit, or good-faith deposit. However, in 2019, the Statewide Housing Security & Tenant Protection Act of 2019 and the Housing Stability & Tenant Protection Act of 2019 (referred to as the Acts), restricted this option, stating that now application fees and security deposits must remain under a set amount of money. This prevents unfair approval processes, as landlords could previously choose between two qualified applicants based on who offered more money, leaving little room for renters with an average income.

As of September 2022, applicants only pay an application fee when applying for an apartment. If approved, they will pay other costs. A landlord, lessor, sub-lessor, or grantor can only charge $20 for an application fee. If the applicant provides a copy of a background check or credit check from the past thirty days, the owner must waive the fee.

If the application is not accepted, you will not get the $20 application fee back. If you’re applying with roommates, each roommate must pay the $20 application fee.

You can avoid falling for scams by ensuring that you never submit payment to someone you have never met for an apartment you have never seen. If something feels too good to be true, that is likely the case.

The Credit Check

Part of your $20 application fee goes toward a credit check, which pulls your credit score for the the landlord or management company to review. Typically speaking, you will want a credit score of at least 700 to qualify for an apartment.

You can click here to check your credit scores ahead of time. This check conducts a soft pull that does not decrease your score. However, you should know that the application credit check will conduct a hard pull of your credit that temporarily decreases your score.