Rental property owners face tough decisions when deciding how to maximize income on their unit. Part of this includes their rental strategy: should they list their property as a vacation rental (such as Airbnb or Vrbo) or a long-term rental with a standard 12-month lease?

This decision can mean the difference of thousands of dollars in net rental income each year. And to make matters more confusing, returns can vary wildly based on the city and bedroom type of each property.

To help shed light on this problem, we at RentHop partnered with AirDNA, the leader in vacation rental analytics. We compared AirDNA’s vacation rental data with our own long-term rental data across the 50 largest U.S. cities.

The results below describe our analysis, and provide an accurate snapshot of how rental property owners can maximize profits based on their property’s city and bedroom type.

Key Takeaways

- Smaller units are better suited as long-term rentals in most cities. However, as bedroom count increases, units become more lucrative to list as vacation rentals. By the time a property increases to four bedrooms, listing it as a vacation rental is more profitable in 90% of cities.

- In cities with high tourism demand, vacation rentals are more profitable than long-term rentals at lower bedroom counts.

- Unsurprisingly, long-term rentals are more favorable in cities with higher long-term rent prices, regardless of bedroom count. This occurs in cities such as NYC, Miami, Los Angeles, and Oakland.

One Bedroom Rentals

If you own a one-bedroom rental property, you’ll likely want to list it as a traditional lease. In fact, one-bedroom units were more profitable as long-term rentals in 96% of cities, when compared with vacation rentals.

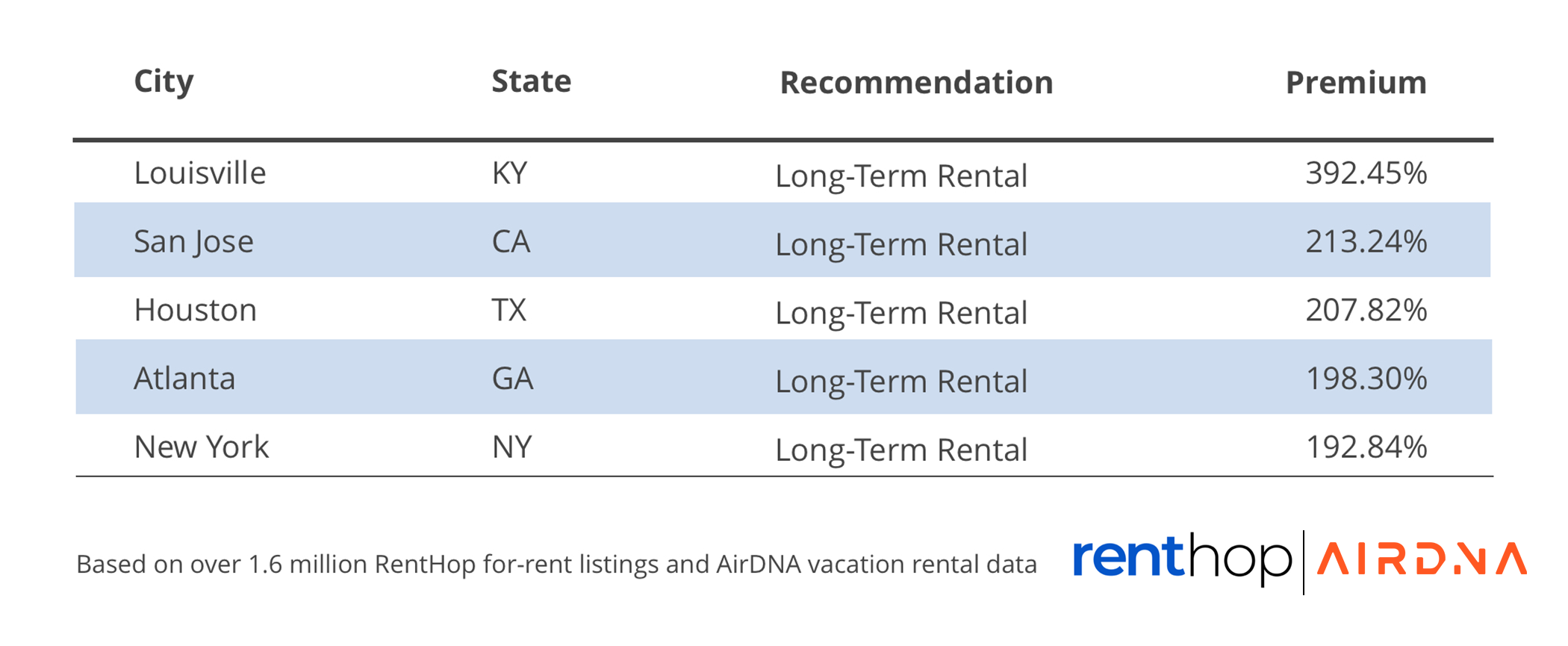

Cities with the Highest Long-Term Return for a One Bedroom Rental

Louisville, San Jose, and Houston saw the highest ROI for long-term rentals of a one-bedroom unit. In Louisville, a property owner can make 392% more each year by renting out their property as a long-term rental rather than a vacation property.

Cities with the Highest Vacation Return for a One Bedroom Rental

Only two cities, Nashville and Virginia Beach, saw one-bedroom vacation rentals outpace traditional leases. Considering the vibrant tourism industry in Nashville, it makes sense that a one bed can generate 44.94% more income as a vacation rental.

A similar case applies to Virginia Beach, where owners make an average net income of $766.23 per month, or $9,194.76 per year, from those looking to take a beach vacation.

Two Bedroom Rentals

Two-bedroom units were more profitable to list as a long-term lease in 64% of cities, compared with vacation rentals.

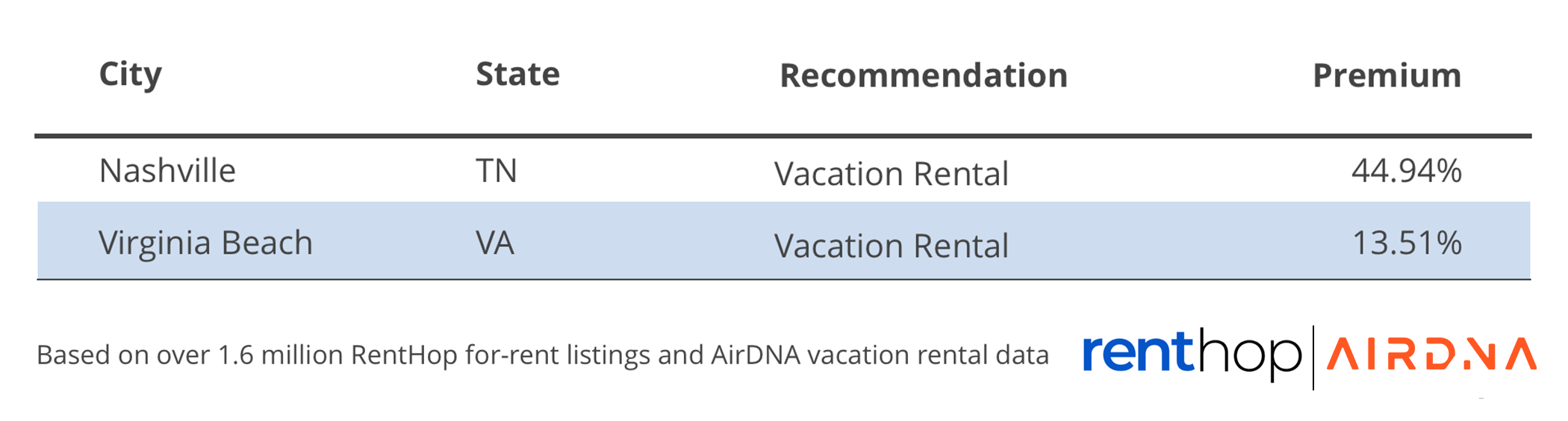

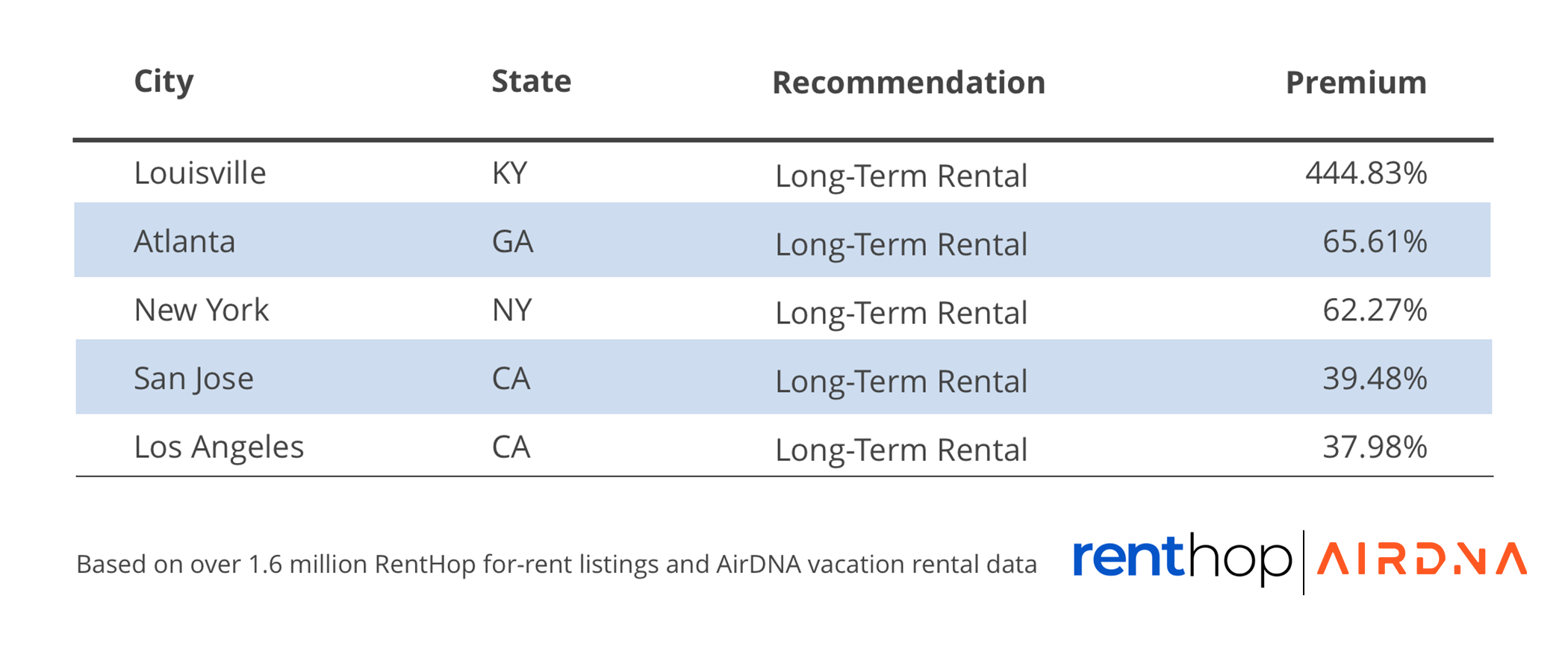

Cities with the Highest Long-Term Return for a Two Bedroom Rental

Louisville, Atlanta, and Mesa see the largest difference in profits when renting units as a long-term versus vacation rental. San Jose, while fifth in overall returns, had the highest net rental income out of these top five cities, where owners make $9,591.48 per year on average.

Cities with the Highest Vacation Return for a Two Bedroom Rental

Vacation rentals were more lucrative in only 18 out of 50 cities on our list, led by Milwaukee, Virginia Beach, and Memphis. Property owners in Milwaukee charge an average of $141.62 per night on Airbnb for their two bed, leading to a yearly net rental income of $10,862.16.

Three Bedroom Rentals

Vacation rentals outperformed long-term leases in 64% of cities for a three-bedroom unit.

One explanation for this shift from long-term to vacation at this level is the increased demand and nightly rate for larger properties on Airbnb. For big groups, many vacationers forgo traditional hotels and seek out larger three-bedroom properties on Airbnb and Vrbo. Larger properties also usually have amenities such as a pool, jacuzzi, or yard that can increase the average nightly rate.

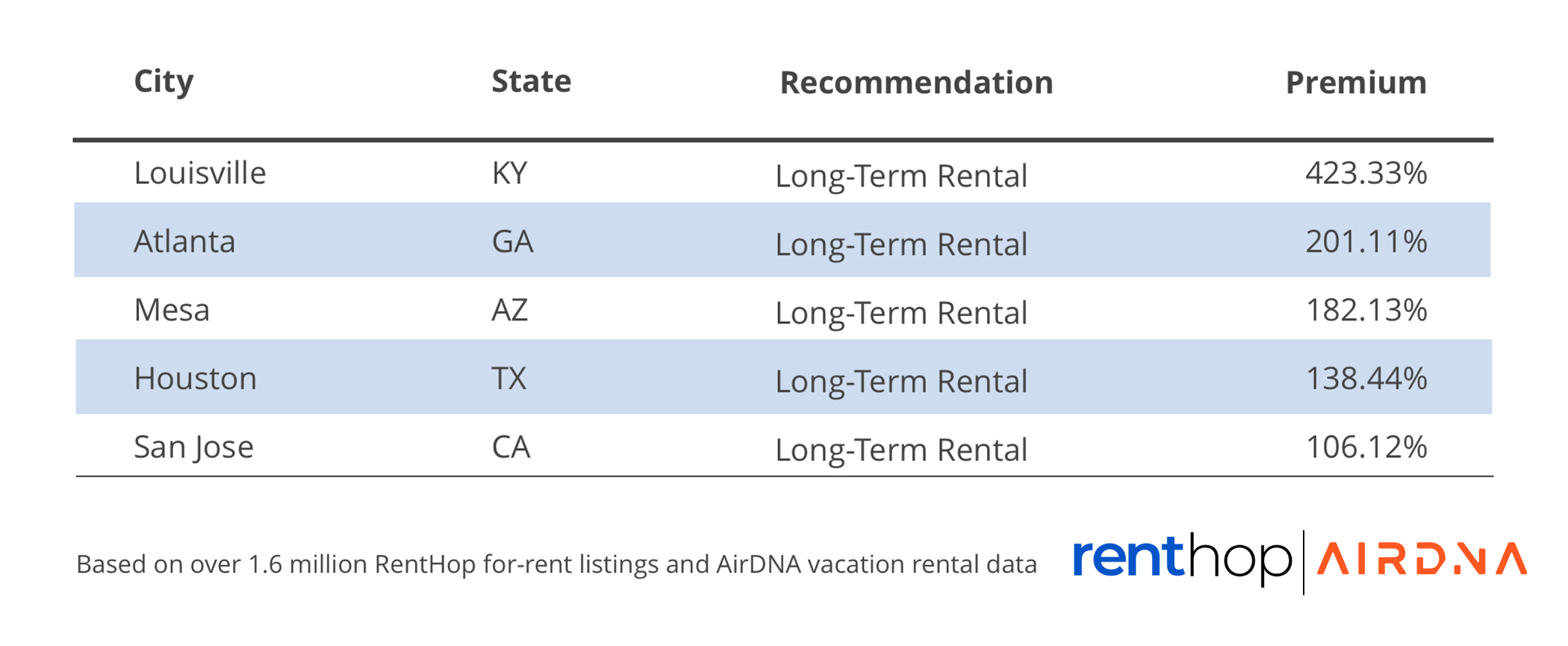

Cities with the Highest Long-Term Return for a Three Bedroom Rental

Long-term rentals were more lucrative in only 16 out of 50 cities on our list, led by Louisville, Atlanta, and New York City.

In cities with unaffordable housing markets like New York and Los Angeles, it makes sense that long-term rental owners continue to return a high lease value on three beds, as many residents must rent when they cannot afford the cost of buying a home.

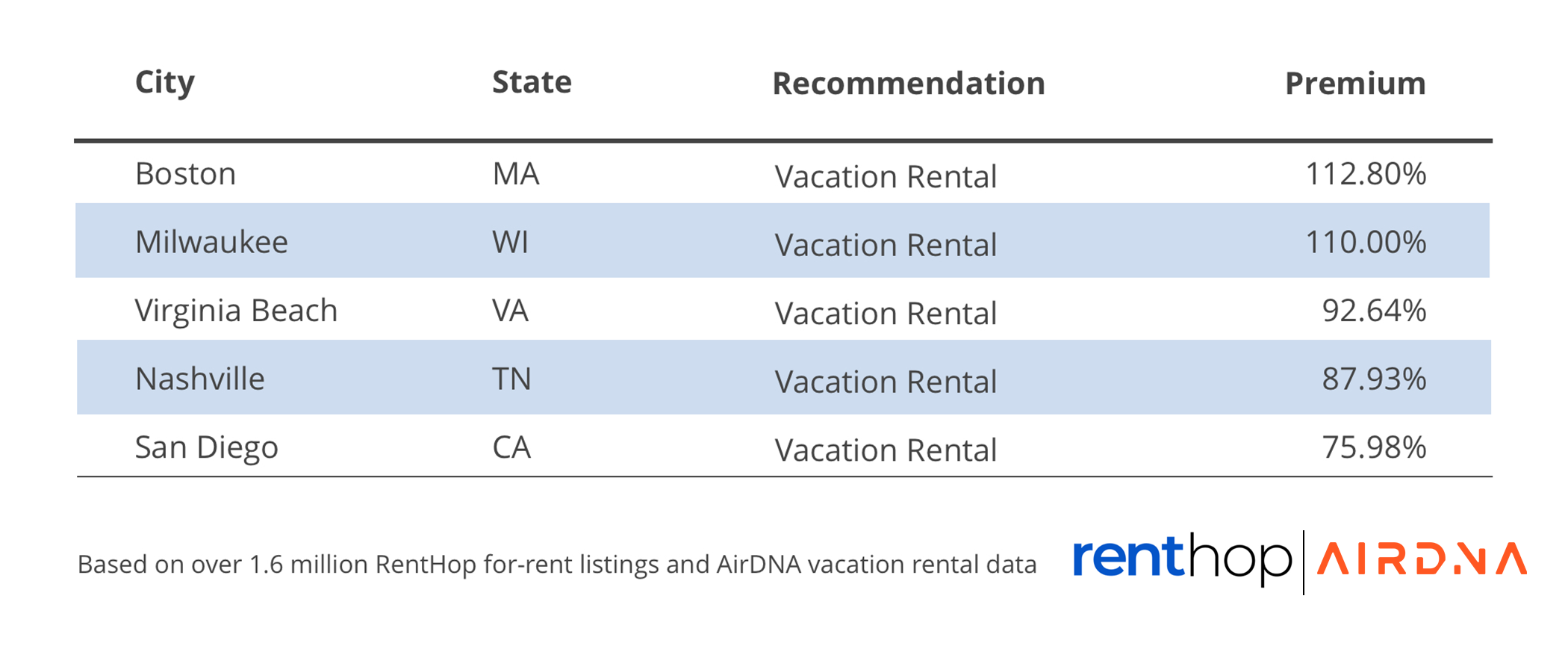

Cities with the Highest Vacation Return for a Three Bedroom Rental

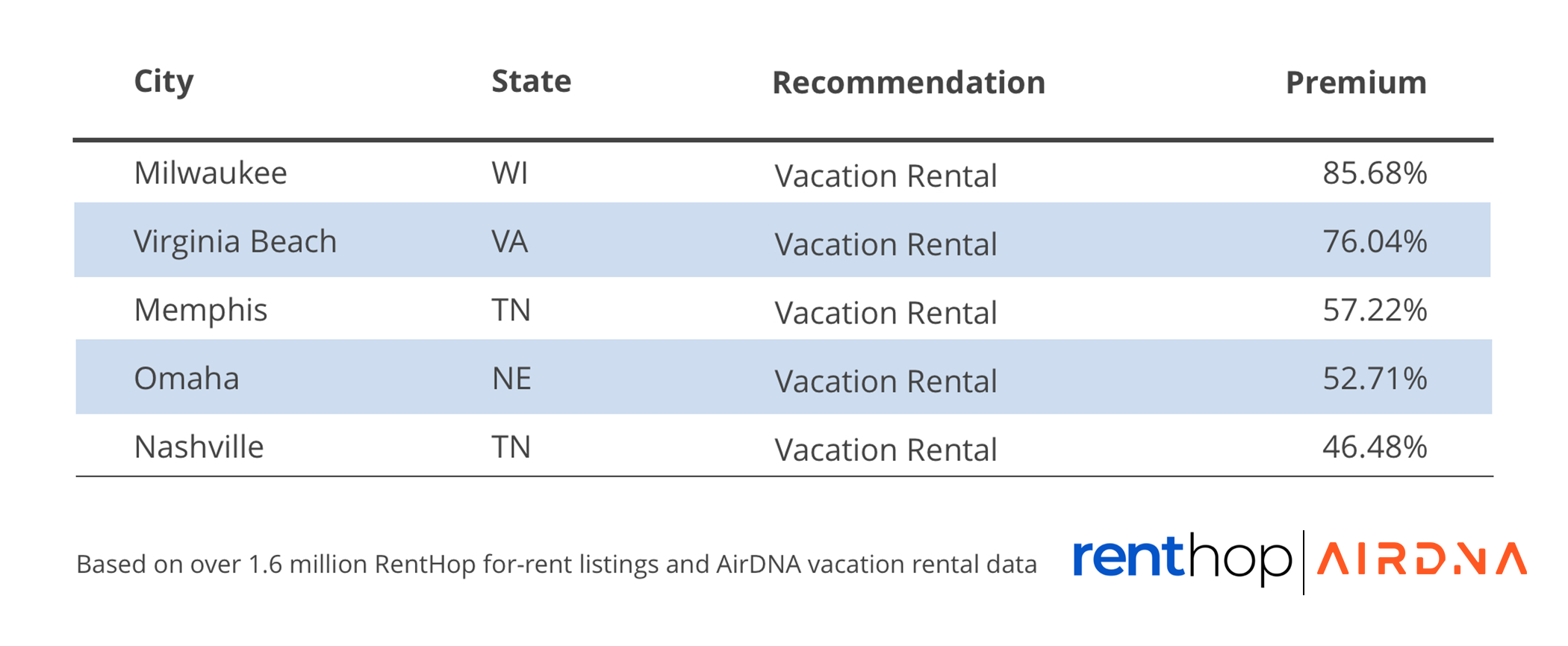

For Boston, Milwaukee, and Virginia Beach, owners can generate significantly higher income by listing their three-bedroom as a vacation rental over a long-term rental. In Boston, property owners with this type make 112.80% more by listing on Airbnb, due to an average daily rate of $550.14 and impressive monthly income of $3,724.03.

Four Bedroom Rentals

Have a four-bedroom property? You should likely list it on Airbnb. Vacation rentals outperformed long-term leases in 90% of cities for this bedroom size.

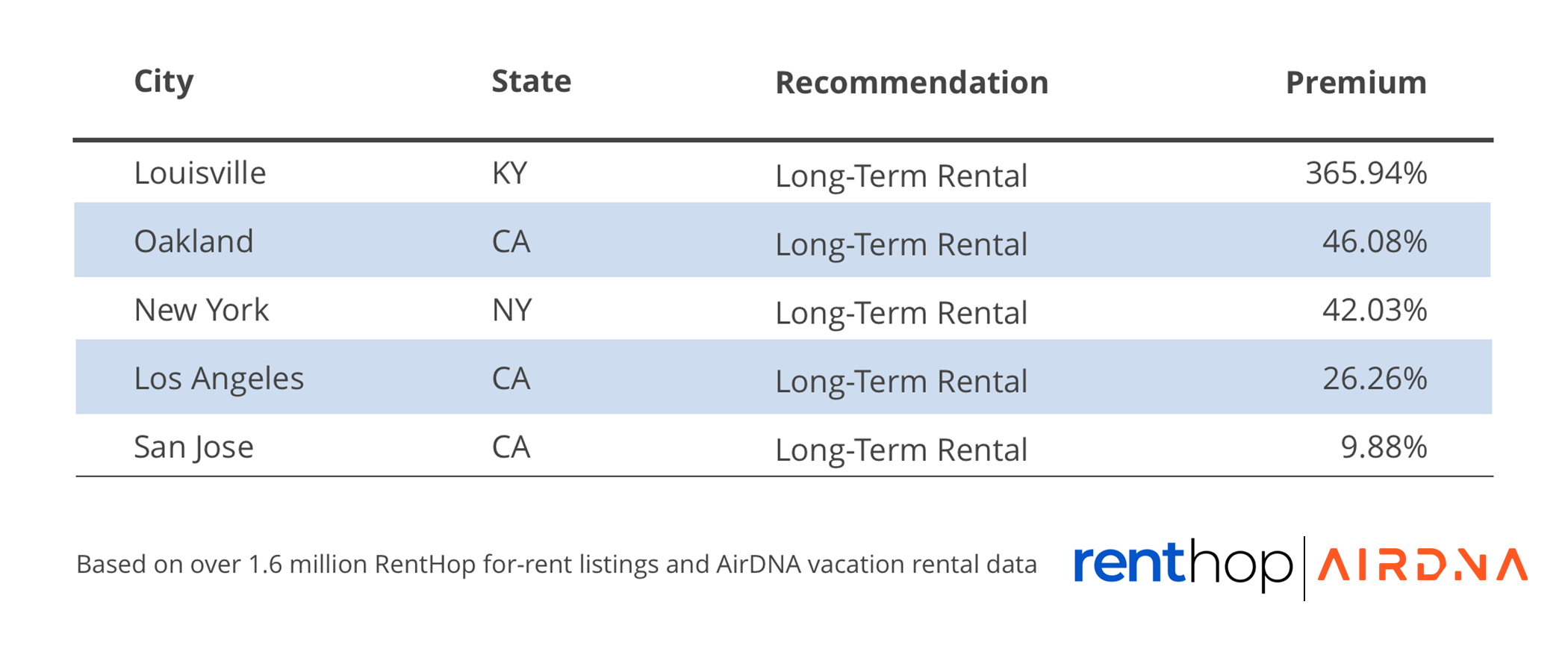

Cities with the Highest Long-Term Return for a Four Bedroom Rental

There are only a handful of cities where property owners can generate higher profits by listing their four bed as a long-term rental, led by Louisville and Oakland.

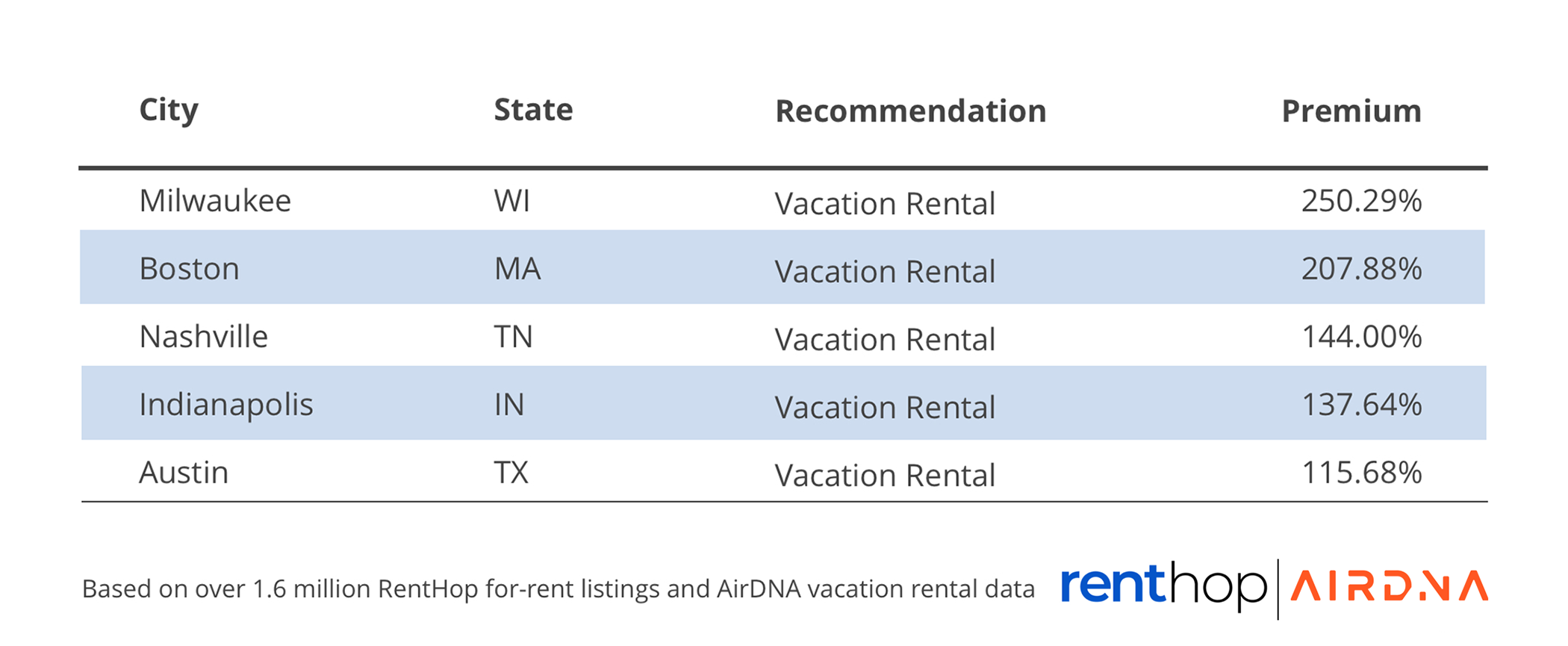

Cities with the Highest Vacation Return for a Four Bedroom Rental

Milwaukee, Boston, and Nashville see the highest spreads when listing a four-bedroom as a vacation rental instead of a long-term lease.

Other Notable Findings

- Nashville: Vacation rentals are more lucrative for every bedroom type in Nashville. The city remains a popular tourist destination, especially for bachelor and bachelorette parties. Property owners listing on Airbnb can expect over 5 stays per month, with an average of almost 3 nights per stay.

- Virginia Beach: Similar to Nashville, property owners in Virginia Beach profit more on every bedroom type when listed as a vacation rental.

- Boston: Three bedroom and four-bedroom units in Boston are among the top 10 property types with the highest vacation returns versus long-term. Boston’s nightly Airbnb rates increased 42% between July 2019 and August 2022, specifically due to increased rates in the luxury tier that raised overall averages. Property owners have leveraged these higher daily rates to their advantage.

- Louisville: Long-term rentals significantly outperform vacation rentals in Louisville, regardless of bedroom size. The city, unfortunately, does not have a strong enough hospitality industry to drive vacation demand, leading to traditional leases being far more lucrative.

Vacation vs. Long-Term Rental Profits by Bedroom Count by City

Limitations

This study interprets vacation rental data to determine whether it is more lucrative for a property owner to rent their unit as a vacation or long-term rental. This study assumes 50% operating expenses across all cities. However, vacation rentals can have extra operating expenses compared to long-term rentals, as property owners typically cover utilities such as internet and electricity.

While this study differentiates based on bedroom count, it does not distinguish between property size and type. Different land, features, and other amenities can also impact these data. This idea is especially true with three and four bedroom properties, as they commonly have amenities such as pools, yards, finished basements, and views, that increase the amount a property owner can charge.

Methodology

This study focused on how rental property owners across the largest 50 U.S. cities can maximize rental profits. To calculate the long-term rental median by bedroom count, we analyzed over 1.6 million rental listings created on RentHop between March 1, 2022 and August 31, 2022. We then calculate the monthly net operating income by bedroom count based on 50% operating expenses. For the purpose of this study, we included only one-bedroom, two-bedroom, three-bedroom, and four-bedroom properties.

Monthly vacation rental net operating income was calculated using data supplied by AirDNA, including daily average rates, total nights booked, and available listings between March 2022 and August 2022. We assumed 50% operating expenses for property owners to run a vacation rental. In addition, to fairly compare vacation rental and long-term rental profits, only entire-unit vacation rental bookings were included in the dataset.

For more information on our methodology, or to contact our data team, please email press@renthop.com.