Does anyone remember ZipRealty? Back in the Dotcom 1.0 era, they were among the first widespread discount real estate brokerage companies with a reasonably strong presence in the west coast. I have fond memories of using their saved search features to track listings prices through the 2004-2010 boom and bust!

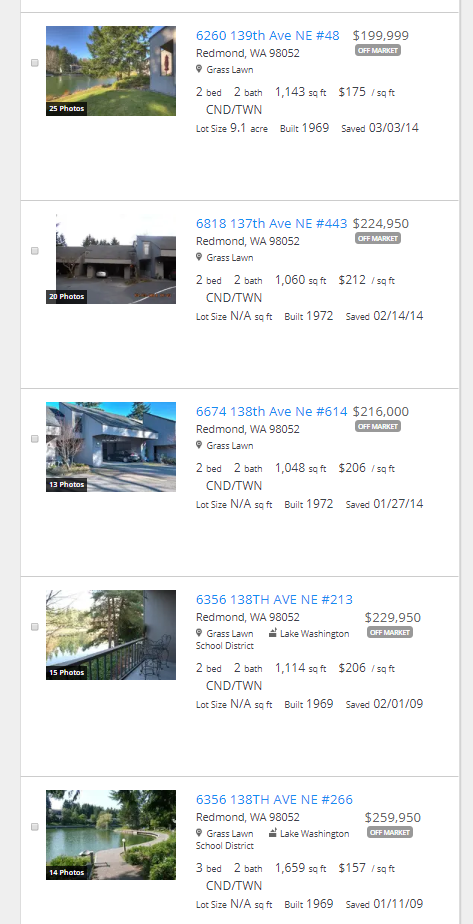

Thanks to RealtyHop’s Public Record search, it is no secret that I made my first investment in a Redmond, Washington condominium for $130K (and amazingly held it for 13 years). ZipRealty sold in 2014, but my online profile is still intact, as well as my list of comparables I tracked over the years to estimate how my property was trending.

Unfortunately for ZipRealty, they came too early for its time. Despite having a strong technology, they were a discount brokerage that didn’t offer any compelling reason to transact using their agents other than the rebate. Coupled with dotcom paced growth, they self-selected for some dubious quality agents.

I remember getting a very angry call, very late at night, Boston time when I still in graduate school. The ZipRealty agent “assigned” to my account yelled at me, said one of her other clients had back-stabbed her by using another agent, and accused me of doing the same because “that’s what all the Microsoft new hires do.”

She said she was kicking me off the platform – of course I’m still half asleep and have no idea what she’s talking about. The next day I got an email locking me out of the account, so I promptly created a new account with username “leelin2”, still in use today.

Why Did ZipRealty Fail?

First of all, can we say for certain that ZipRealty failed? They were a publicly-traded company for many years and without a doubt served many thousands of consumers and agents. Many of their early search mechanics are still present in modern-day real estate search portals. However, given all of the early success, their market share eventually atrophied to something that rounds to 0%.

One of the biggest problems with the ZipRealty model comes from adverse selection. In this case, it’s also an example of revealed preference (one of those funny terms economists love). If you are a busy real estate agent with a long list of happy clients and referrals, you would never agree to the ZipRealty model of discounting your commission by 20%. Therefore, the agents who join ZipRealty are the ones who otherwise have enough empty time on their calendar to meet with discounted clients. That creates a classic feedback loop of mediocre agents with mediocre service, plus an extra chip on their shoulders knowing the client is getting a discount (will you really provide the same effort)?

During my very first real estate licensing class, I still remember a crucial story from the instructor. He once found the objectively perfect house for his client. It was in a great neighborhood with appreciating house values. It was priced competitively. It was convenient for going to work and close to his place of worship. After asking if the client wanted to submit an offer, the client responded, “I don’t like the color of the bathroom tiles.”

Real estate is not all math and finance. Quants can dominate the stock market with algorithms and systematic rules. But in the world of real estate, we need to respect the human and emotional component of the equation.

Case Study On How Not to DRIP Campaign Your Users

A secondary problem came from ZipRealty’s model of assigning agents and clients. When a user begins searching on ZipRealty, they will eventually be asked to register an email to save their searches and receive notifications when new inventory arrives on the market. So far so good. The problem is, they had a rigid model where every customer was assigned to an agent, regardless of their actual interest level (just browsing around versus preapproved with a move-date set). Keep in mind, the early 2000s was still a Wild West in terms of internet marketing best practices. There was some sort of DRIP campaign for emails, but I remember getting random calls every once in a while for seemingly no reason from the human agent. They really didn’t do a great job qualifying leads, or directing the agent towards their most high probability converters.

Maybe The Discount Model Is Doomed From The Start?

For those who remember, Foxtons also attempted to break into New York City long ago with a discount brokerage model, specifically rebating part of the commission. Even as late as 2007, many of the street corner hotdog stands still had “Foxtons” umbrellas, despite their exit from the market years prior. So why doesn’t it work? At first glance, it seems reasonable. More sophisticated buyers don’t need all of the hand-holding compared to that of a first-time homebuyer. They can use the internet to look for exactly what they want, and they only need a buyers’ agent to help submit the offer and drive things through closing. Why isn’t there a viable niche of buyers and agents who fit this model?

Perhaps the answer lies not just with the agents, but also the clients. Just as there is an adverse selection with the quality of agents, a discount brokerage portal may see an adverse selection problem with the customers! That’s basically a nice way of saying, ZipRealty attracted price-sensitive and savvy customers — the ones that are unwilling to blindly follow what the agents recommend.

ZipRealty’s Rise and Fall: Cracking the Network Effect

Even after knowing the eventual results with 20/20 hindsight (and 2021 hindsight), we should give fair credit to the ZipRealty founders Scott Kucirek and Juan Mini, two UC Berkeley business school grads who launched ZipRealty in 1999. Growing a successful two-sided marketplace is always challenging, and the real estate sector adds many uniquely annoying obstacles. The classic Harvard Business School case study Killing Craigslist, by Ben Edelman and Peter Coles, summarizes many of the key issues that real estate websites RentHop and RentJungle faced.

First, there are strong network effects in place: consumers look for the venue with the most complete inventory, but relevant data providers tend to guard their intellectual property and only partner with listings platforms that already have a critical mass of traffic. Listings tend not to be exclusive to one online portal – a home seller can easily multi-home onto multiple websites and competing platforms. Finally, there is still a disintermediation problem — even if you successfully match a buyer and seller, they can easily transact offline.

In the case of ZipRealty, they chose the registered brokerage method for cracking the chicken and egg problem. That is, by becoming a fully licensed brokerage in various states, they were regular members of various Multiple Listing Services (MLS). With the MLS data, they could easily aggregate exclusive listings from other firms and leverage MLS co-broke agreements to represent the property buyers for their initial transactions. Their innovation was layering a rich search interface and other buyer folio tracking technology on top of the traditional brokerage model. That way, consumers would gain all of the data that a traditional brokerage could provide, while also taking advantage of the do-it-yourself online search model.

As a brokerage, ZipRealty had to recruit agents. They launched heavy recruiting campaigns to poach both experienced and brand new agents, and for years they were successful. ZipRealty agents could focus all of their efforts on showing and closing, rather than sourcing leads. The leads came directly from the ZipRealty website, and the company technology tried to automate as much as possible. ZipRealty also took the unique step of passing some of the savings to the consumers via the commission rebate.

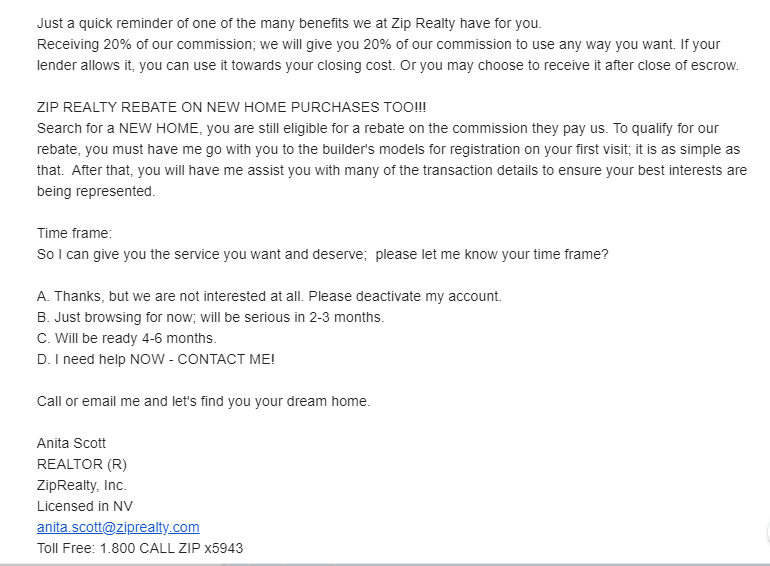

How Much Commission Did ZipRealty Refund / Rebate?

We had to dig through some very old emails to find specific terms from the classic ZipRealty rebate deal. Here is a 2008 era marketing email, from a Nevada-based ZipRealty agent. Note by 2008, ZipRealty was still a contender in the online portal wars, but they were already quickly losing ground to Zillow, Trulia, and Redfin. The new kids on the block were quickly crowding out the old guard (and now, RealtyHop is the new new kid on the block).

ZipRealty had a sliding scale for the exact commission rebate, but it was generally 0.60% of the purchase price for buyers, and 0.75% of the purchase price for sellers. The actual quoted amount might have sounded a lot higher. For example, ZipRealty marketing campaigns could claim that the agent would refund 20% of their hard-earned commission dollars if you allow them to represent you when buying. However, remember the commission rebate assumes a standard 6% commission paid to the brokers, of which half goes to the buyer’s agent (3%), and then you get 20% of 3% which is 0.60% of the purchase price.

In the case when you are willing to sell your house via ZipRealty, you could in theory save even more. They would give up 25% of the usual seller’s half of the commission. Again, using the same math, once you sign an exclusive with ZipRealty, you still offer 3% to the buyer’s brokerage, but only 2.25% to ZipRealty to be the listing brokerage instead of the usual 3%. Sell a $600K condo and instead of the usual $36K commission, you only pay $31.5K, saving $4500, or 0.75% of the selling price.

Is the rebate worth it? Do you get a slightly less experienced agent who will screw things up more than the 0.6% savings? Or do you actually get a tech savvy, more dedicated and less distracted agent? From personal experience, the quality of agents was a mixed bag.

Vegas ZipRealty Agent 2009: I Recommend Countrywide!

I remember touring Vegas properties in 2009, just after the financial crisis, with my brother, father, and a college blackjack buddy. We were looking at some REOs and short sales in the infamous MGM Signature condo-hotel project. Units that sold for over $700K during the height of the 2006 mania were suddenly struggling to get takers for $200K. Still, to ensure proper leverage, I asked the agent if there were lenders that could provide financing for these condo-hotel units. She thought for a moment and said, “Ohh, yes of course you can get a mortgage. I like using Countrywide!!” For a real estate professional, she must have missed the many articles about Countrywide’s mortage frauds, political scandals, and other dubious practices that led to their ultimate demise.

ZipRealty, Honeycomb, and Realogy Group Merger

By 2014, ZipRealty signed their definitive agreement to be merged and acquired by Realogy Group. If Realogy sounds familiar, they are the same folks beyond Corcoran, Citi Habitats (now fully Corcoran), Sotheby’s, Better Homes and Gardens, and a whole lot of other folks. The merger was actually slightly more complicated because ZipRealty was up to that point a publicly traded company, now fully merging as a subsidiary into another publicly traded company.

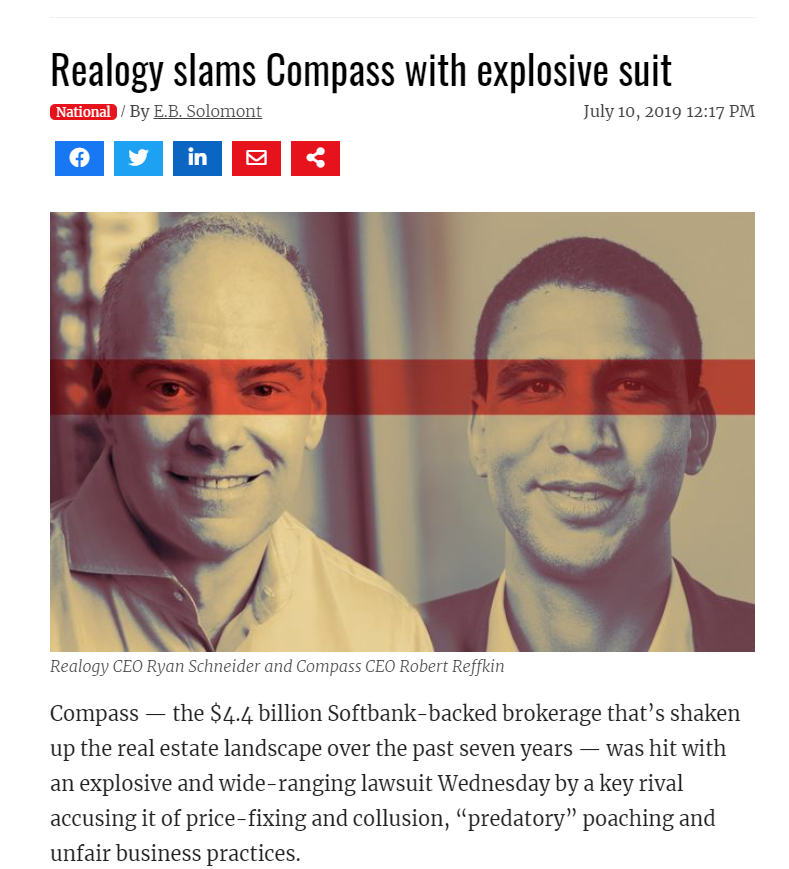

At the time of the acquisition, Realogy had a market cap of $5 billion, although the value has eroded considerably in the following years. New competitors such as Redfin and Compass have gained significant market share, and the valuable of brokerage companies in general are lower in a world where listings portals have increased in value. Ultimately, Realogy filed a massive lawsuit against Compass, claiming various unfair business practices such as poaching agents in a way that violates non-compete agreements and other intellectual property breaches. They also accused Compass of spreading rumors, saying Realogy was going bankrupt (not true, their quarterly financials are publicly available).

Back to ZipRealty, the mechanism for the Realogy merger was to first use the intermediate entity, Honeycomb Acquisition, Inc., and then the combined entity would be a fully-owned subsidiary of parent company Realogy Group LLC. The CEO of ZipRealty, Lanny Baker, would stay on as head of ZipRealty, reporting through the new different structure. Why make it so complicated? Taking a company private requires various changes to clean up the cap table, and Realogy prefers a structure of various wholly-owned subsidiaries. The closing date for all of this was July 15, 2014.

Lanny Baker, James D. Wilson Salary, Offer, and Mandate

Once the merger closed, executives Lanny Baker as CEO and James Wilson as Senior VP of Technology would stay on with ZipRealty. They had a mandate to continue operating the ZipRealty brand and leverage the new combined company technology, data, and resources to turn ZipRealty back on course.

Lanny Baker, aka Charles C. Baker, received a base salary of $400,000 per year, with a 50% performance bonus if he reaches various targets. He also received an equity grant worth up to $1.2 million in Realogy Holdings Corp equity, 40% in stock options and 60% in restricted shares that requires hitting performance targets. In this case, the total notional amount for Mr. Baker is far more than $1.2 million, given the leverage common in fair-market value, at-the-money call options. Lastly, if Mr. Baker was terminated without cause, or resigns after a salary reduction, he would receive $400,000 in severance.

James had a slightly less generous package, but still quite cushy. He received $300,000 a year in base salary with a 35% performance bonus for reaching targets. The stock and equity award would be $450,000, also 40% options and 60% restricted stock. Interestingly, although James had a similar severance protection clause of $300,000, it was only valid if his termination occurs prior to July 15th, 2016.

As it turns out, there was no reason for the shorter severance protection for James Wilson. Less than two years later, Lanny Baker is the one who moved on to join Yelp as CFO. James Wilson was promoted to the ZipRealty CEO. A few years later, Realogy decided to fold ZipRealty brokerage agents into Coldwell Banker, effectively consolidating their branding and eliminating ZipRealty as a consumer-facing brand. Whatever is left of ZipRealty, 20 years after founding, is primarily back end technology and code.

Bottom Line: ZipRealty Was An Interesting Idea, Failed In Execution

ZipRealty was among the first consumer real estate portals to tastefully incorporate nationwide MLS listings with a rich search, agent match-making, saved queries, and a saved listings library. Their software and technical execution paved the way for a rapid rise and eventual IPO, plus several years of strong growth following the IPO.

Ultimately, their main struggles stemmed from the human side of the operation. Real estate is a technical subject, but in the end still largely an emotional decision made by humans that require lots of hand holding during the home-buying process. ZipRealty’s company culture perhaps focused too much on the technology and operations, and failed to deliver on the personal touch and customer service. Our RedFin in-depth review showcases some prime examples of how ZipRealty might have done better.