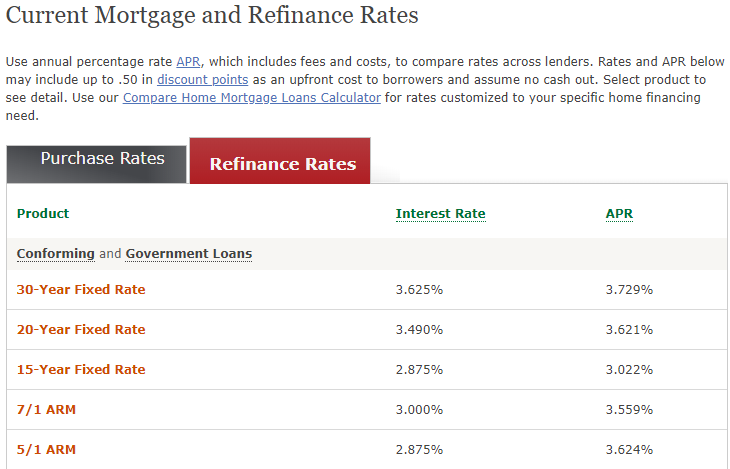

Here is an age old discussion that should have no correct answer. In 2020, whether you are purchasing or refinancing, do you want to lock in record low fixed rate mortgages, or go for the one of those 5/1 and 7/1 ARMs.

The Boilerplate Answers

We can give all of the usual “it depends” answers. Do you plan to live in that condo the rest of your life? Or will you move out once you start a family? Will you try your hand at becoming a landlord and keep the property long after you trade up?

How About A Real Answer?

Here is a real answer. Currently in 2020, the spread between a 30-year Fixed and a 7/1 ARM about 0.500%. That’s not a bad deal – truth is, data shows VERY few people actually keep the mortgage longer than 7 years. You will either refinance or sell the property by then, or just prepay voluntarily because your financial situation has changed.

Even if you do hit the 7 year mark, which I have on my oldest properties, your new rate might not be so horrible. They build in a nice margin over LIBOR, so unfortunately you probably won’t get anything lower than the initial 7 year teaser. But it might not be any higher.

And if for some reason your rate skyrockets, you still banked 7 years of savings. You would need to hold the higher rate for 2-3 years before those savings vanished. The real breakeven might be 10 years on a 7/1 ARM, in nominal terms. And trust me, by then, your life situation will have changed drastically – you might not even care. In the end, it’s all about peace of mind; sometimes I wish there was no choice and everyone just offered an identical product (in theory they should, thanks to Fannie And Freddie, but some banks sneak in way too many extra fees).

When Is Fixed-Rate Better?

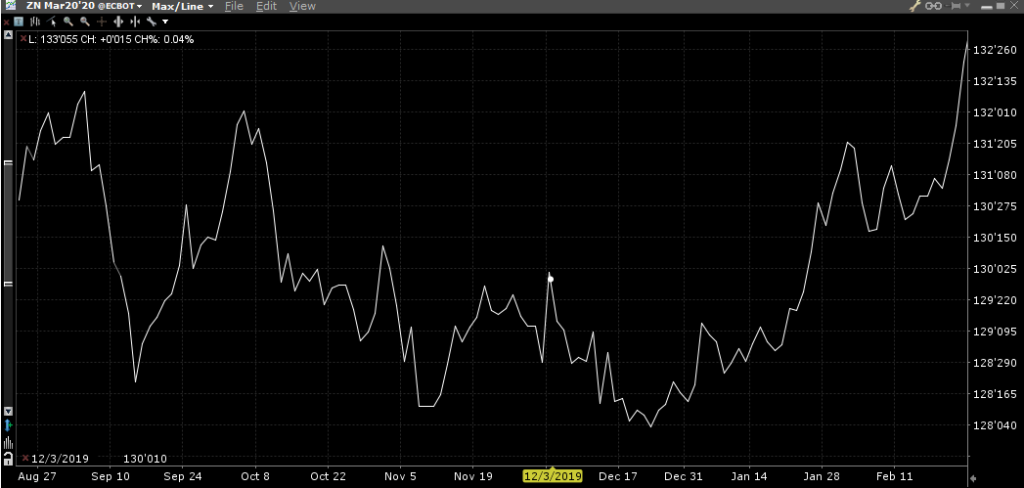

There were moments in the past 5 years when the Fixed vs ARM was actually equal! That sounds weird, but the yield curve was just totally flat at the time. For those who really aren’t sure about their future plans, if the 7/1 ARM and 30-year Fixed only have a spread of 0.250%, it’s probably not worth it. You can buy the peace of mind and pay more – just don’t have regrets when you refinance 3 years later! It’s a calculated gamble.