There’s an old rule of thumb that says you should look to spend only 30 percent of your pre-tax income on rent every month. According to federal guidelines, people who spend more than 30 percent of their income on housing are considered cost burdened and if you spend more than 50 percent you’re considered extremely cost burdened. If you’re living in one of U.S. major cities, or you’re classified as a millennial, there’s a high chance you fall into the category of being extremely cost burdened. Another good way of calculating just how much you can afford as your monthly rent is by implementing the 40-times rule. Meaning, make sure to check if your annual income is at least 40-times the monthly rent.

Living in a big city such as New York City or Los Angeles is great, but it’s not cheap. Can’t make rent this month, either? Here are some tips on how to make rent while still managing to pay all of your bills on time.

1. Move to a different neighborhood

Moving to a different area is a viable option for those struggling to make rent every month. If you won’t budge on giving up certain amenities, you should at least consider relocating. You might be dead set on living in a certain neighborhood, based on the area’s reputation and overall attractiveness. But would you reconsider giving that up if moving to another neighborhood meant saving several hundred dollars every month?

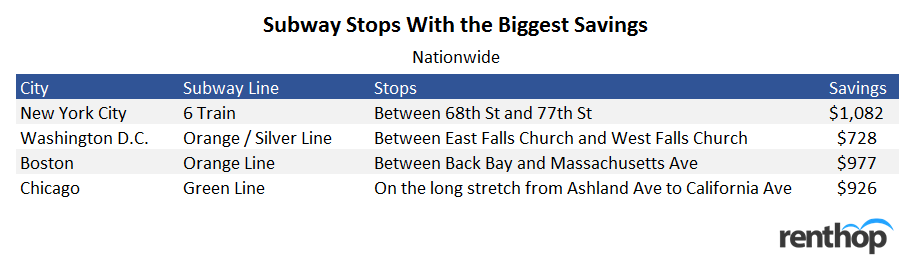

In the last couple of months, we’ve been publishing our updated Rents by Subway Stop 2017 data studies. Our data scientists took on the task of mapping out rental prices by subway stop for New York City, Boston, Chicago, and Washington D.C. The goal of this study was to help renters make an informed rental decision about their next apartment. When looking at these big metropolitan areas, this is what we found in the form of big savings.

In Chicago, there are 800,000 people using the CTA ‘L’ train system each weekday. Making it safe to say that the renters of Chicago are probably factoring in the ‘L’ train, and the time it takes to commute to work when looking for an apartment. Washington D.C. has the third busiest rail system in the nation, with nearly 750,000 weekday riders. And then there’s Boston, one of the largest rapid transit systems in the nation, behind New York City and Chicago. Bottom line, when renting in these cities, renters tend to take into account the commute and public transportation.

New York City is the perfect example of this. New Yorkers can attest to how big a part the New York’s MTA subway system plays in their daily life. When looking for an apartment, most New Yorkers tend to calculate in the subway when looking for a new place. A shorter commute to work? Perfect. But if you can save a few hundred dollars every month by moving just a couple of stops away on the same train, isn’t that a good investment? Adding a couple of minutes to the overall travel time might be worth it to ensure you can make ends meet every month.

2. Downgrade the apartment

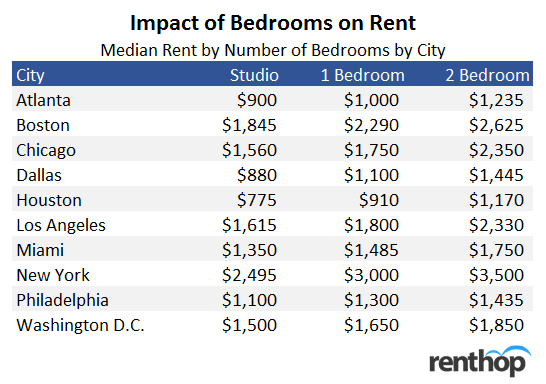

Securing the perfect apartment with top notch amenities to go along with it is a goal for most people. However, getting an apartment with certain features might be difficult to come by, depending on your budget. If you can’t afford to pay rent, you need to think about downsizing or downgrading your apartment as size and certain features have a correlation with a high monthly rent. Below you’ll see the price difference between the size of the apartment, showing the median rent for a studio, a 1 bedroom, and a 2 bedroom in selected cities.

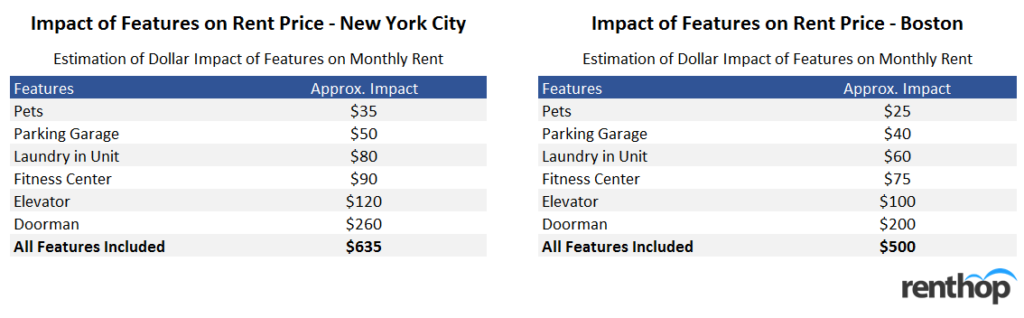

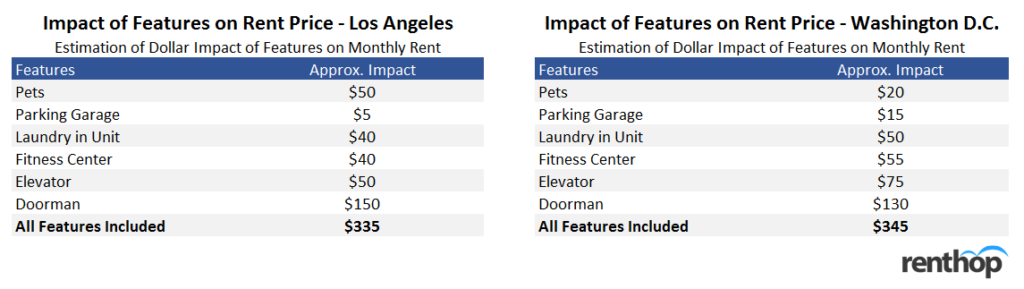

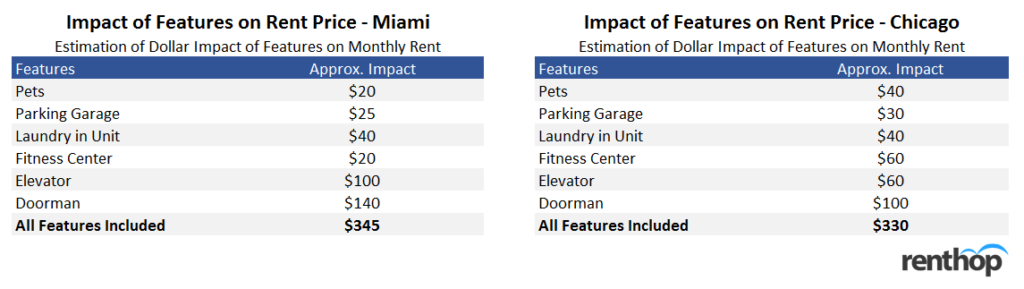

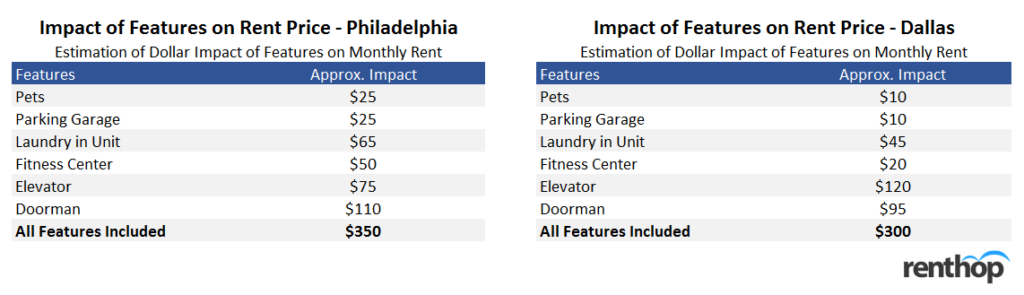

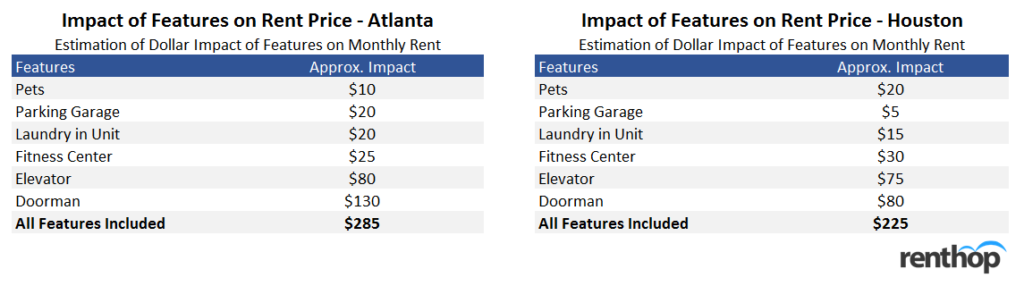

Recognize what you can live without. For example, is it necessary to have an apartment that has two bathrooms? Back in February, we did a study on the features that are increasing your rent. Our findings show that you can easily save a lot of money by downgrading your apartment a bit. Having a doorman, elevator, fitness center, laundry in unit, and parking are most correlated with a higher price.

If living in a walk-up is saving you over $200 a month, isn’t it then worth it to get rid of the elevator? Obey the 30 percent threshold rule when it comes to renting or make sure your annual income is at least 40-times the monthly rent to avoid putting yourself in a tiresome financial situation. Downgrade your apartment by finding an apartment with fewer features. Doing so could save you hundreds of dollars in the end. See below to view how much certain features could impact the rent price in selected cities.

3. Get a roommate or two

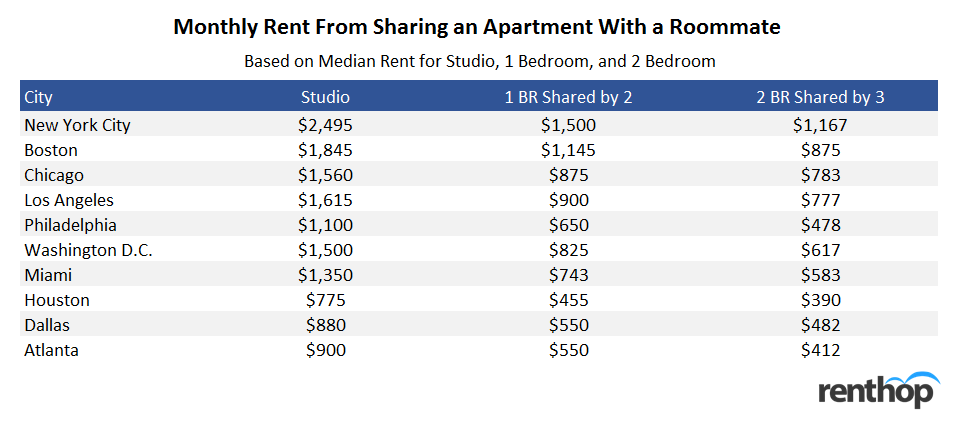

Don’t want to give up certain amenities but you can’t seem to make ends meet at times? Get a roommate to split the bills with. Stating the obvious, a 2 bedroom apartment will always be the more expensive option over a studio and a 1 bedroom apartment. But it can also be the most economical option. If you share a 2 bedroom apartment with one person, you end up saving money. If you share the same 2 bedroom apartment with two more people, your savings increase significantly. Instead of paying rent by yourself every month, take a look at how much you could end up paying if you shared an apartment with roommates instead.

Looking at the numbers, you can save the most money sharing a 2 bedroom apartment with two other people in Houston, paying only $390 a month. The most you’ll spend for a 2 bedroom shared with two other people is in New York City, where the price per month equals $1,167. You’ll be saving the most by upgrading to a 2 bedroom and splitting the bill by three. Even upgrading to a 1 bedroom and splitting it with one person will save you more than paying for a studio by yourself.

Obviously, people could also choose to have a studio apartment and share it with one more person by setting up a wall, making the apartment function as a flex apartment. However, it’s important to note that studios are generally the most expensive per room because the common space (kitchens, bathrooms, etc) isn’t shared.

4. Programs that can help cover rent

The following options are recommended for those who are having a hard time paying rent and looking for financial support to ensure they have a roof over their head. However, you should have a place when applying for programs or affordable housing lotteries, as there are many people applying for the same thing.

Certain programs are designed to help people who can’t make rent, as long as they are eligible to receive financial support. These programs, also known as “Rental Assistance Programs,” have a mission to help low-income tenants and families keep their current housing through providing financial support. Such rental assistance programs can be given through the government, charity programs, local resources, non-profits, etc. Do your research on short and long term assistance programs where you’re living. If you qualify as a low – to moderate-income family, you could be eligible for various programs. See the following examples of resources for selected cities to read up on when looking for more information on affordable housing and various rental assistance programs.

- Los Angeles: HCIDLA

- Boston: EOHED

- Washington D.C.: DCHA

- New York City: NYC Department of Homeless Services

Another option for low-income individuals or families having a hard time paying rent in full capacity in New York City is looking into affordable housing lotteries. The goal of affordable housing lotteries is to ensure the less fortunate don’t get left behind. NYC Housing Connect allows you to search for lotteries in regards to affordable housing opportunities, and the site provides information on how to apply, who’s eligible, and currently available housing opportunities throughout the city.

5. Talk to your landlord

Before making any drastic changes, like moving to a smaller apartment, giving your landlord a call would be smart. Unless it is specified in your lease agreement that late payments aren’t accepted, you can see if your landlord would be willing to accept a late payment for the month in question. A landlord might accept late payments or partial payment on a later date. But this varies from landlord to landlord. It helps having a previously good relationship with your landlord and also no history of late payments. It also helps if you’re renting from a small-time landlord, such as a friend of a friend looking to rent out the downstairs apartment and so on.

6. Renegotiate your lease

Is your lease up for renewal soon? If that’s the case, you have a golden opportunity to save some money. The moment your lease is up your landlord might try to increase the rent. This is normal. Before giving into increased rent, try to renegotiate. It might not work and you’ll either be left with a higher rent or you moving. Or, it works and you don’t have to worry about either one of those options. Renegotiating usually works if you know there isn’t a lot of applicants interested in the apartment. A vacant apartment is a loss for any landlord or owner so it doesn’t hurt to try.

Another thing that could save you some money in regards to the lease is to sign a longer lease. Usually, a landlord will give you the option of a standard lease of 12 months. Obviously, there are reasons for you to opt for a shorter lease, specifically if you’re looking for shorter-term housing only. However, if you opt for a longer lease it could save you some money in the long run.

7. Illegal vs. legal apartments

Different cities have different rules on what is legal and what is not when it comes to apartments. Meaning, if you decide to relocate and you were previously used to living in certain living conditions, the same conditions might be considered a violation of building regulations and standards in a different city. Which would also classify the apartment as an illegal apartment. If you’re used to certain living conditions you might be ok with the same type of apartment in a different city, even though it’s now classified as an illegal apartment. Also, many renters choose for example the option of a cramped, windowless cellar over an overpriced rental unit to save some money. So what actually qualifies as an illegal apartment?

When it comes to illegal units, no matter where they’re located, an apartment cannot be a safety hazard or violate building regulations and standards set by local law. Any rental unit must meet requirements such as the apartment providing proper heating and ventilation. Plumbing and electrical needs also need to be in order. So what kind of regulations do you need to review to check if an apartment is legal? Like previously mentioned, different cities have different regulations and standards. For example, apartments in Chicago have to comply with the City of Chicago Building Code and Chicago’s zoning requirements. In New York City, NYC law prohibits the rental of cellars, while basements can be legal. Renters can check to see if a rental unit is legal or not by checking the local building regulations and standards.

So, are illegal housing options always a bad option? Not necessarily. Obviously, there are building regulations for a reason. While some apartments might actually be a safety hazard, other apartments might not comply with the same standards as the city where you were previously located. Also, while some apartments might be in violation of regulations and standards, the reason behind it might not be a deal breaker for some, such as:

- The number of occupants in the apartment is more than allowed

- Illegal sublets

- Apartments without windows

- Apartments with unusual layouts

It’s important to note that not all illegal housing options are bad. Obviously, we would never recommend an apartment that imposes an actual threat to save some money. But there are options that technically qualify as an illegal apartment, but that doesn’t pose any threat to occupants. So where do you look when looking for illegal housing opportunities? You’ll probably have a hard time finding illegal housing options on rental platforms, as most platforms have certain requirements for listings that go up on their site. You’re probably better off perusing newspapers, especially foreign language newspapers, which will probably list more than one option.

8. Rental seasonality

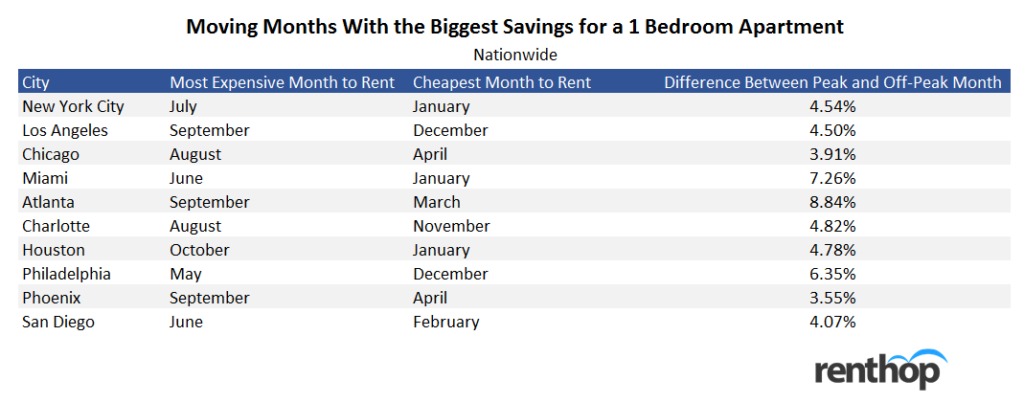

Can you save money on when you move? Yes. Which season and month you decide to move in could have a significant impact on how much you will have to pay for your apartment. Usually, the winter months are the best months to move in, since fewer people are changing locations due to new jobs or commencing school. Therefore, landlords are left with more available apartments in the Winter and will, therefore, be willing to decrease the monthly rent just to ensure an apartment doesn’t stay vacant. But exactly which months are the best months for each certain cities?

*Percentages are from a study back in 2016, showing the difference in percentage between the cheapest and the most expensive month to move.

When looking at the peak and off-peak months for the selected major U.S. cities, we see that the difference between the peak and the off-peak month can save you a significant amount of money. The city with the biggest difference between its peak and off-peak month is Atlanta, with an 8.84% difference. Rent is at its highest in September with a rent increase of 4.93 percent and its lowest in March with a decrease of 3.91 percent. The city with the lowest difference between its peak and off-peak month is Phoenix. September, like Atlanta, is the month with the highest rent but the increase is only by 1.48 percent. The month with the biggest decrease for Phonix is April, with a 2.07 percent.

Moving in an off-peak season could save you some money on rent moving forward. If you move during an off-peak month instead of a peak month, and that saves you $200 or more, that’s money saved.

9. Subletting your apartment

Are you looking to move out before your lease is over? If so, you could earn some money by renting out your apartment for the time being. You could also make some extra money by renting out a room in your apartment or the living room if you’re ok with a temporary roommate situation. However, before putting your apartment or room up for sublet, you need to check a couple of things first.

- Is it specified in your lease agreement that subletting your apartment is forbidden?

- Have you asked your landlord for permission?

- Are there other local laws stating your type of apartment can’t be subject to subletting?

If it’s specified in your lease agreement that subletting the apartment is forbidden, or your landlord says no to subletting, you probably shouldn’t go through with it. Illegally subletting your apartment, or a room in your apartment, could be considered a violation of your lease. Don’t put yourself in a position where you decide to move forward with subletting your apartment without asking permission. However, people do illegally sublet their apartments all the time. If your landlord is a friend of a friend, or a small-time landlord, you probably have a better chance of being allowed to sublet your place than if you were living in a co-op. Check the rules on subletting in the city you’re living in before deciding on subletting your place. By law, various cities might have different rules on which apartments, such as co-ops, public housing, etc., are allowed to be subject to subletting.

So how much can you charge for subletting? If you’re living in a major metropolitan area, in a highly popular neighborhood where finding an apartment is hard, making much of a profit might be difficult. For example, if you’re subletting in Los Angeles, New York City, or Chicago you could probably charge full price or higher for your apartment. Charge according to the rental market. There is no profit in charging a ridiculous price for a sublet if there is a low number of renters looking to sublet. Also, an important note is to check local laws and rules regarding subletting and how much you can actually charge to sublet. You might not be able to just pick a price.

***

Making rent is hard, especially if you live in a big city where living expenses are high. If you find yourself in a position where you can’t make rent, you need to take a look at your current spendings. If you’re still having a hard time making rent, you need to consider moving or downgrading your current apartment. Don’t drain your financial resources on things you could change.